BOC Life

Popular Searches:

BOC Life · Your Life Partner

Commenced operation in Hong Kong in 1998, BOC Life upholds the "People-Centricity and Customer-First" principle, dedicated to offering comprehensive life insurance, wealth management, medical, and retirement protection services. Embracing innovation and focusing on high-quality development, BOC Life has become one of the leading life insurance companies in Hong Kong. We strive to create sustainable value for shareholders while cultivating a rewarding environment for our employees as their employer of choice.

0 consecutive years

Leading market share in RMB -denominated insurance policies¹No. 0

Direct sales channels ranking in the market²No. 0

Per capita productivity ranking for Tied Agency in the market³0 -star rating

Corporate rating for fulfillment ratio⁴0

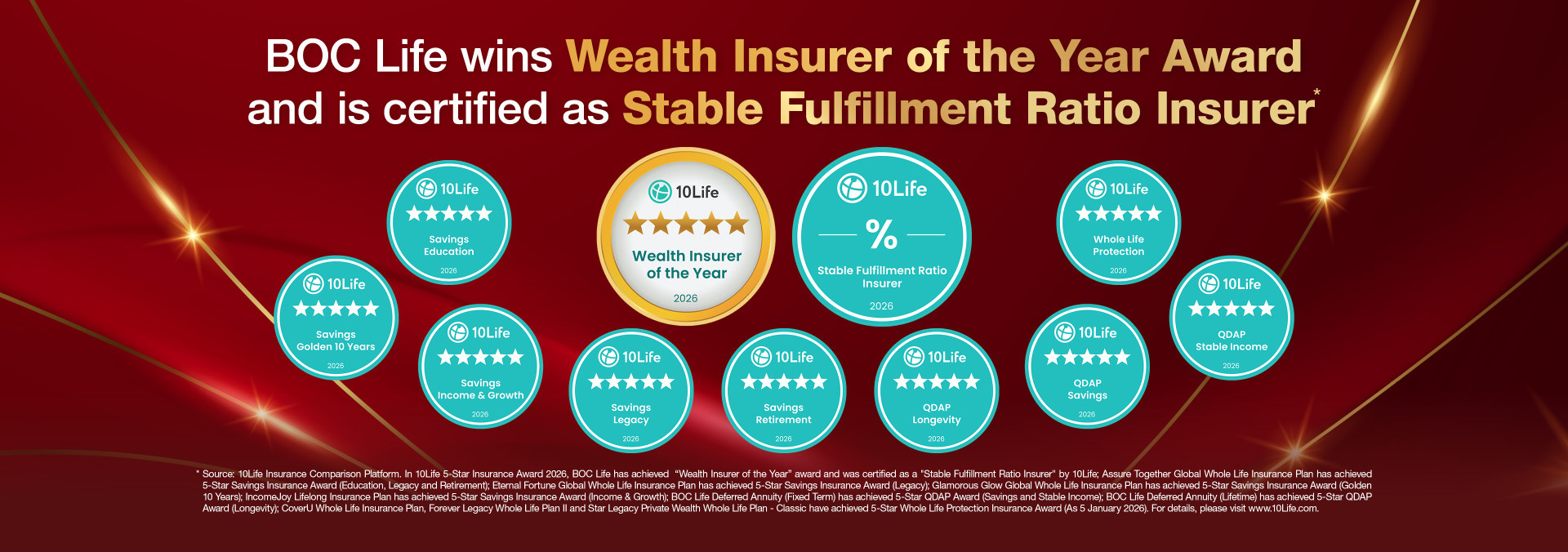

Winner of the 10Life "Wealth Insurer of the Year" for consecutive years⁴Remarks:

- Based on the “Quarterly Release of Provisional Statistics for Long Term Business” published by the Insurance Authority (IA) from 2013 to the first half of 2025 (Statistics for the first half of 2025 are referred to as the “IA’s First Half 2025 Provisional Statistics”) (https://www.ia.org.hk/en/infocenter/statistics/market_7_2025.html), the market rankings are calculated using standard new business premiums for RMB insurance business. The standard new business premiums are defined as the sum of the annualised premiums and 10% of single premiums of new business.

- The standard new business premiums for direct individual life insurance sold through the “Direct sales” Channel, as stated in the IA’s First Half 2025 Provisional Statistics, are calculated. The standard new business premiums are defined as the sum of the annualised premiums and 10 % of single premiums of new business.

- Based on (i) the number of tied agents recorded in the “HK Life Insurance Intermediary Monitor” published by the market research company “Pi Financial Services Intelligence”(as of 30 June 2025), and (ii) the standard new business premiums for direct individual new business (single premiums and annualised premiums) sold though the “Agents” Channel from the IA’s First Half 2025 Provisional Statistics, these figures are compared against BOC Life’s relevant internal data for the same period to derive a general statistical estimation. Per capita productivity is defined as the per capita standard premiums of new policies, calculated by dividing the total standard premiums of new policies by the number of tied agents, using the data of first half of 2025 as the reference. The standard new business premiums are defined as the sum of the annualised premiums and 10% of single premiums of new business.

Awarded by the Hong Kong insurance comparison platform 10Life in the relevant year(s) "10Life 5-Star Insurance Awards".