iTarget 3 Years Savings Insurance Plan

Your dreams at your fingertips

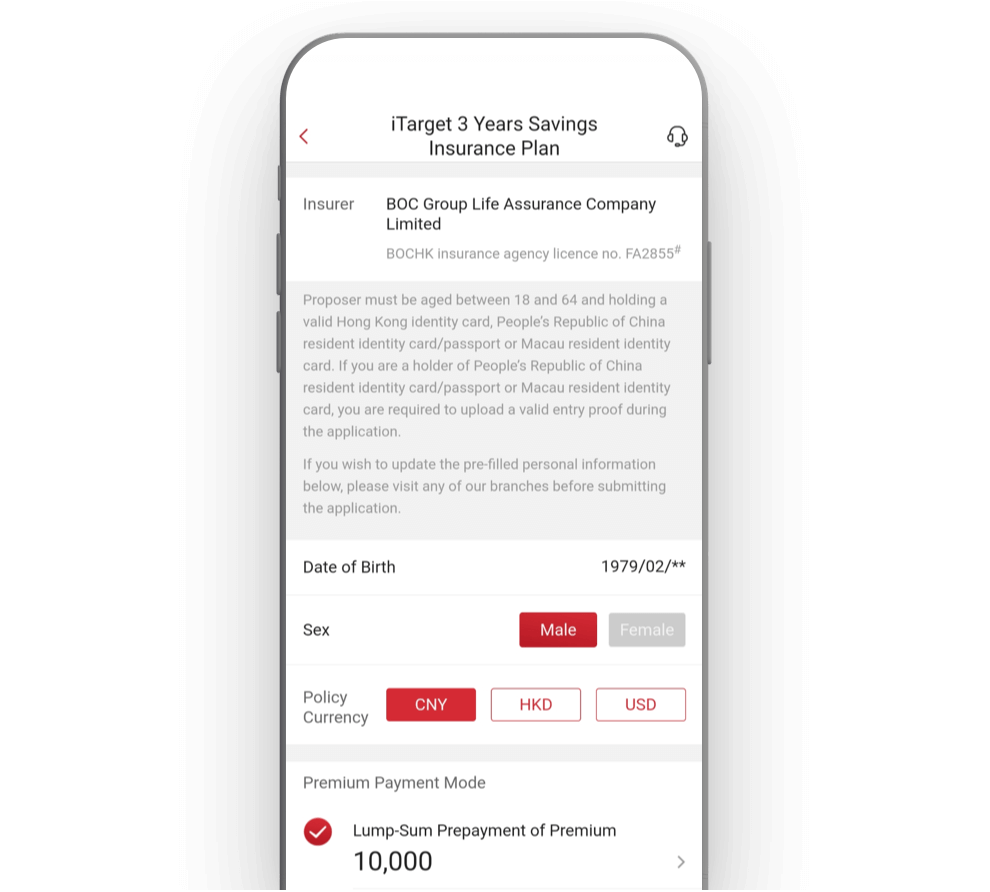

By paying premiums for just 2 years, iTarget 3 Years Savings Insurance Plan (Online Application) (“the Plan”) will provide you with a steady return after 3 years, leading you to achieve your savings goal. You can also enjoy a comprehensive life protection during the period.

-

Pay just 2 years premium for 3 years life protection

-

After first year premium discount, Annualized guaranteed rate1 of return up to 3.90% for USD policy after 3 years

(calculated based on the case of lum-sum prepayment with first year USD premium discount2) -

Flexible premium payment mode for easier financial management

-

Combination of savings and life protection

-

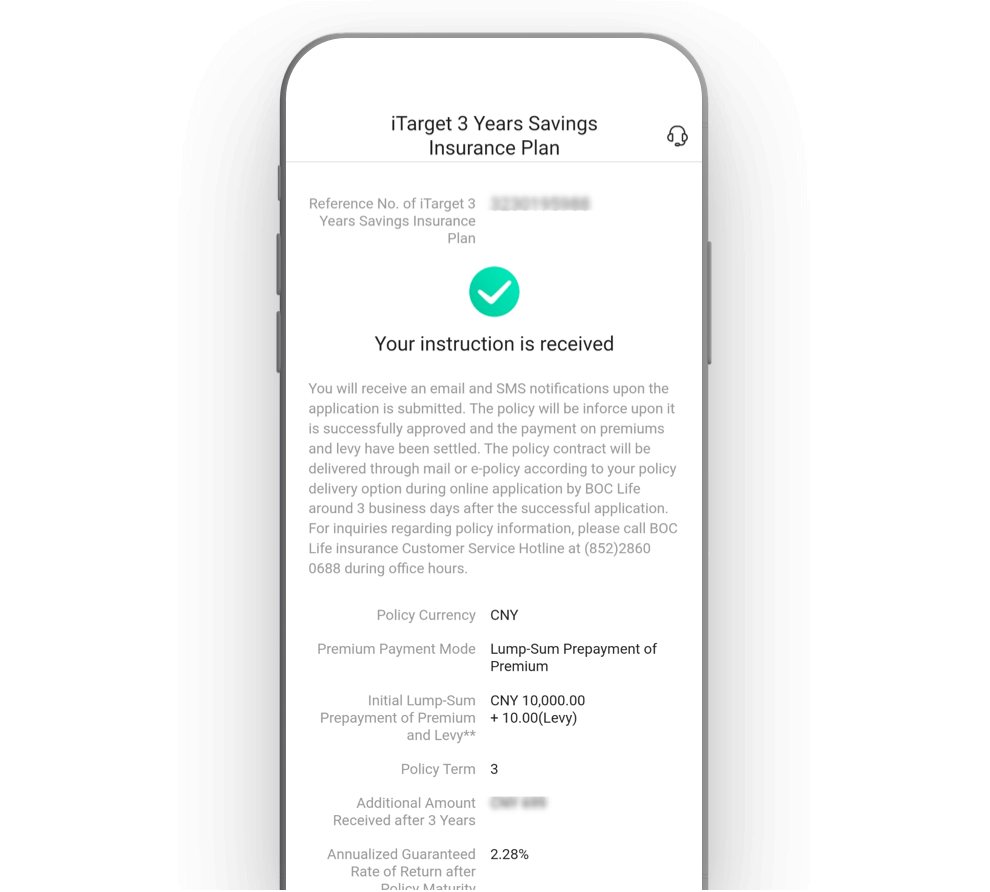

Application via mobile app and website for one-stop self-service experience

| Policy Currency | Lump-sum Prepayment | Annual Payment for 2 years | Monthly Payment for 2 years |

| RMB | 2.90% | 2.57% | 2.01% |

| HKD | 3.10% | 2.77% | 2.25% |

| USD | 3.90% | 3.68% | 3.36% |

Enjoy up to 8.10% first year premium discount and 3.90% annualized guaranteed rate1 of return up

Note: First year premium discount offer is subject to terms and conditions. For details, please refer to the product leaflet.

Remarks:

1. The annualized guaranteed rate of return is subject to the policy currency and premium payment mode you choose. Please refer to the product leaflet for details.

2. First year USD premium discount is subject to terms & conditions. Please refer to the product leaflet for details.

3. Annualized Guaranteed Rate of Return is the annual compound interest rate that total premiums paid is cumulated to the guaranteed amount received at policy maturity date. This percentage is rounded to 2 decimal places, and varies by your chosen policy currency and premium payment mode.

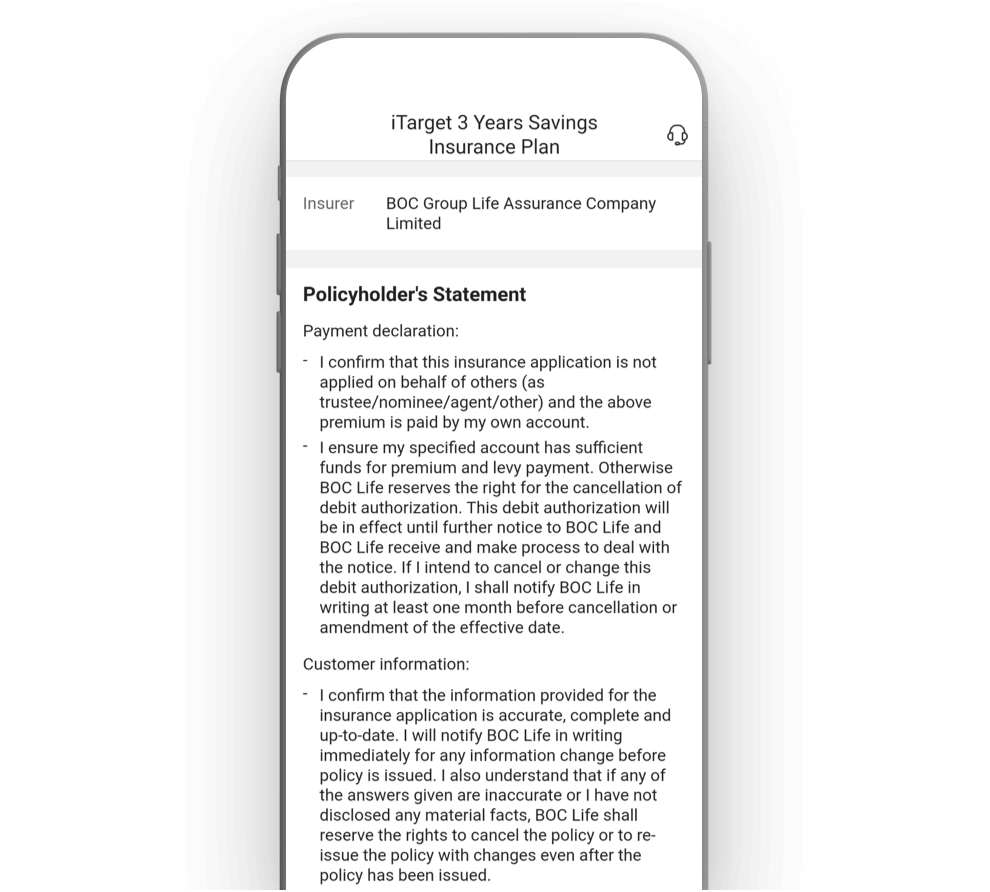

The Policy Owner is subject to the credit risk of BOC Group Life Assurance Company Limited (“BOC Life”). If the Policy Owner discontinues and / or surrenders the insurance plan in the early policy years, the amount of the benefit he / she will get back may be considerably less than the amount of the premium he / she has paid.

Risk Disclosure of RMB and USD Insurance:

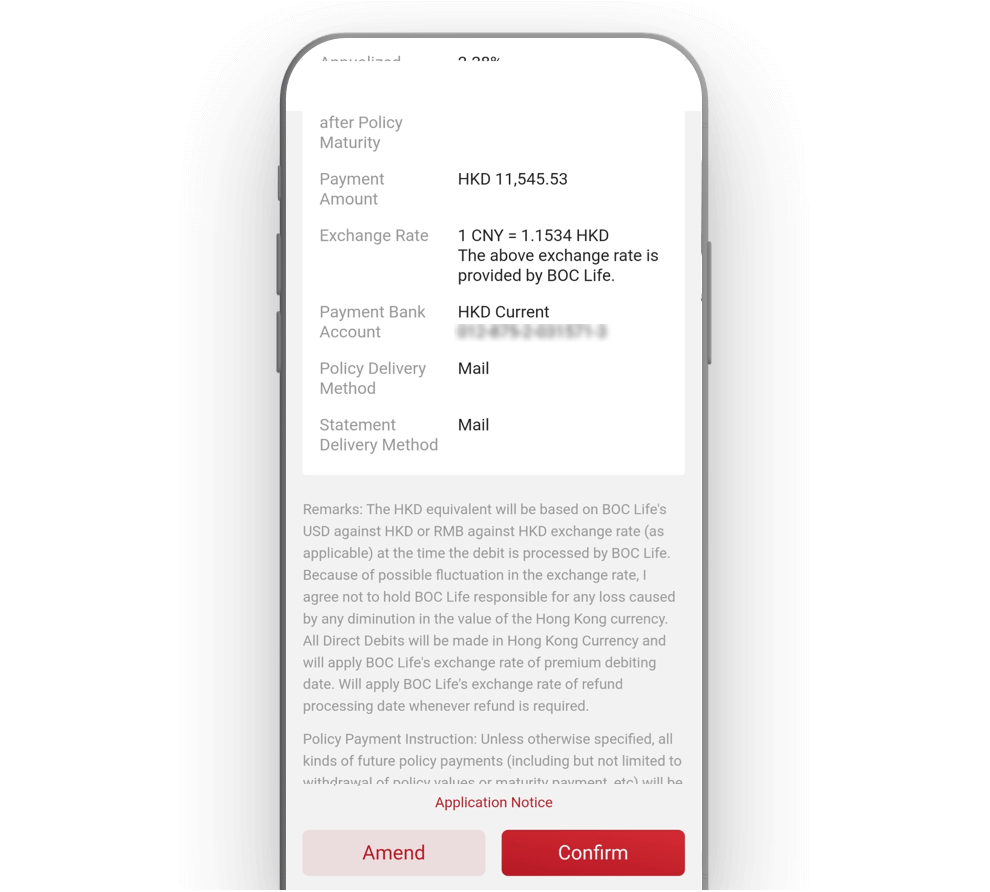

RMB and USD policies are subject to exchange rate risk. The exchange rate between RMB and HKD or USD and HKD may rise as well as fall. Therefore, if calculated in HKD, premiums, fees and charges (if applicable), account value / surrender value and other benefits payable under RMB or USD policy will vary with the exchange rate. The exchange rate between RMB and HKD or USD and HKD will be the market-based prevailing exchange rate determined by BOC Life from time to time, which may not be the same as the spot rate of banks. The fluctuation in exchange rate may result in losses if a customer chooses to pay premiums in HKD, or requests the insurer to pay the account value / surrender value or other benefits payable in HKD, for RMB or USD policy. RMB Conversion Limitation Risk - RMB Insurance is subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Important Notes:

• The Plan is a long-term insurance plan that is underwritten by BOC Life. It is not a bank deposit scheme or bank savings plan. Bank of China (Hong Kong) Limited (“BOCHK”) is the major insurance agency appointed by BOC Life.

• BOC Life is authorised and regulated by Insurance Authority to carry on long term business in the Hong Kong Special Administrative Region of the People's Republic of China (“Hong Kong”).

• BOCHK is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong. (insurance agency licence no. FA2855)

• BOC Life reserves the right to decide at its sole discretion to accept or decline any application for the Plan according to the information provided by the proposed Insured and the applicant at the time of application.

• The Plan is subject to the formal policy documents and provisions issued by BOC Life. Please refer to the relevant policy documents and provisions for details of the insured items and coverage, provisions and exclusions.

• BOCHK is the appointed insurance agency of BOC Life for distribution of life insurance products. The life insurance product is a product of BOC Life but not BOCHK.

• In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the insurance product should be resolved between directly BOC Life and the customer.

• BOCHK and / or BOC Life reserves the right to amend, suspend or terminate the Plan at any time and to amend the relevant terms and conditions. In case of dispute(s), the decision of BOCHK and / or BOC Life shall be final.

• Cooling-off period:

Policy Owner has the right to cancel the policy and obtain a refund of any premium(s) and the levy paid, which are collected by BOC Life on behalf of the Insurance Authority according to the relevant requirements, less any difference caused by exchange rate fluctuation, where applicable, by giving written notice. Such notice must be signed by the Policy Owner and received directly by BOC Life's Principal Office at 13/F, 1111 King's Road, Taikoo Shing, Hong Kong within 21 calendar days after the delivery of the policy or issue of a Notice to the Policy Owner or the representative of the Policy Owner, whichever is the earlier. The Policy Owner understands that BOC Life will notify the Policy Owner of the Cooling-off Period via a Notice and / or text message. If the last day of the Cooling-off Period as indicated in the Notice and / or the text message is not a working day, it will fall on the next working day. No refund can be made if a claim has been admitted.

Should there be any discrepancy between the Chinese and English versions of this promotion material, the English version shall prevail.

This promotion material is for reference only and is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOC Life outside Hong Kong. Please refer to the sales documents, including product brochure, benefit illustration and policy documents and provisions issued by BOC Life for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, policy costs and fees) of the Plan. For enquiry about technical support for online application, please contact BOCHK Customer Service Hotline (852) 3669 3003. For enquiry about product and post-sales service, please contact BOC Life Customer Service Hotline (852) 2860 0688.

This promotion material is published by BOC Life.